What’s Cryptocurrency Origin, Use, Types, Worth

If you are planning to purchase cryptocurrencies, you are in a position to do so by choosing difference between coin and token in crypto «buy,» selecting the order sort, getting into the quantity of cryptocurrencies you need to buy, and confirming the order. This forex is most similar to bitcoin but has moved more rapidly to develop new innovations, including quicker funds and processes to allow extra transactions. The first cryptocurrency was Bitcoin, which was founded in 2009 and stays one of the best identified today. Much of the curiosity in cryptocurrencies is to commerce for profit, with speculators at times driving prices skyward.

Explained: Every Thing You Have To Know About Cryptocurrencies

Users can even get hold of Bitcoin addresses, which operate like accounts, at a Bitcoin exchanger or on-line pockets service. The underlying know-how utilized by bitcoin for securing the transactions is called “block chain”. This know-how has many other functions although bitcoin will not be acceptable. Distributed ledger system or the block chain expertise allows organization of any chain of information or transactions without the need of intermediaries.

Tremendous Six: Is Paris Olympics India’s Best-ever Performance? Olympic Tales, Ep 12

Non-Bitcoin cryptocurrencies are collectively known as “altcoins” to inform apart them from the original. Founded in 2009, Bitcoin was the first cryptocurrency and continues to be probably the most commonly traded. The currency was developed by Satoshi Nakamoto – broadly believed to be a pseudonym for a person or group of individuals whose exact identification remains unknown. Furthermore, the Bitcoin community is so designed that it can solely have 21 million units of Bitcoin circulation at any point in time. This restricted availability is a main part that drives its market value.

Former Isi Chief Faiz Hameed Arrested In Reference To Housing Scheme Scandal

One of essentially the most notable acceptors of cryptocurrency as a viable medium of payment is Apple Inc. It allows 10 kinds of cryptocurrencies for carrying out transactions within the App Store. However, only miners are approved to verify transactions within a cryptocurrency community. They want to solve cryptographic puzzles to verify any particular transaction.

What Are The Various Varieties Of Cryptocurrencies?

You additionally don’t need to worry about checking account restrictions, similar to ATM withdrawal limits. Although government laws are absent from the cryptocurrency market, they are taxable belongings. You’ll have to file any revenue or loss with the Internal Revenue Service.

What Are The Benefits Of Bitcoins And Cryptocurrencies?

Quite simply, anything on a ledger that doesn’t match with other ledgers will get cancelled. This is a math-based, decentralised convertible virtual forex that is protected by cryptography. The prime five kinds of cryptocurrencies are utility tokens, security tokens, stablecoins, fee tokens, and change tokens.

If you understand the above instance, it is extremely straightforward to translate it to an adult version. All the mother and father and kids within the North Pole blockchain are ‘nodes’. Each node has a replica of what is occurring within the system and might validate it. Whenever someone tries to govern, they are caught instantly, and therefore the network is secured always. As the name suggests, a WRAP token is one thing that’s wrapped round an underlying asset.

Earlier Than You Put Cash Into Crypto, Know The Dangers

Unlike crypto coins, tokens wouldn’t have their native blockchain network but are built on existing blockchains. For example, Polygon is a token that makes use of the Ethereum blockchain to facilitate cheaper and faster transactions. Cryptocurrency may be purchased on peer-to-peer networks and cryptocurrency exchanges, similar to Coinbase and Bitfinex.

- Individuals sometimes use exchangers to deposit and withdraw cash from digital currency accounts.

- Similarly, ETH and SOL are the one coins that can be used to pay for the gas charge inside their respective networks.

- Transactions are encrypted, and data are immutable on the blockchain, thus disallowing any alterations or changes to be made.

Some exchanges present wallet services, making it straightforward for you to store instantly through the platform. However, not all exchanges or brokers automatically provide pockets companies for you. Ergo, cryptocurrencies are mere transactions or entries in a shared ledger that can only be modified upon assembly sure prerequisites. Cryptocurrency, or crypto, is virtual or digital assets bought with real money ($, £) traded on blockchain know-how. It does not have all the values of actual or fiat currencies. Cryptocurrencies, like Bitcoin and Ethereum, are different from shares and actual money.

Unlike traditional forex, which you can carry around and exchange in the actual world, crypto completely features on the digital platform. Cryptocurrency is a digital, decentralised foreign money which operates on a publicly distributed ledger mechanism known as a blockchain. Developed in 2015, Ethereum is a blockchain platform with its personal cryptocurrency, called Ether (ETH) or Ethereum. Compared to different variants of cryptocurrency, models of Bitcoin may be bought extra conveniently owing to a massive quantity of choices. Individuals can choose to purchase it from cryptocurrency exchanges, utilizing reward cards, through investment trusts.

The coin limit for BTC is 21 million, whereas, for LTC, it is eighty four million. They additionally perform on totally different algorithms- LTC operates on ‘Scrypt’, whereas Bitcoin operates on ‘SHA-256’. While there are totally different sorts of wallets, every has its advantages, technical requirements, and safety.

Cryptocurrencies allow peer-to-peer transactions across borders virtually instantaneously at very low prices. However, cryptocurrencies are highly risky and speculative. As of November 2023, there are 10,748 total cryptocurrencies and the total market cap of all cryptocurrencies is $2.forty one Trillion. Cryptocurrency has gained much popularity within the Indian market, particularly after the pandemic. However, considering the number of fanatics and potential traders, India has a fantastic prospect for crypto market. As crypto is decentralised, you’ll have the ability to invest in crypto with out the concern of confiscation or interference from a 3rd party.

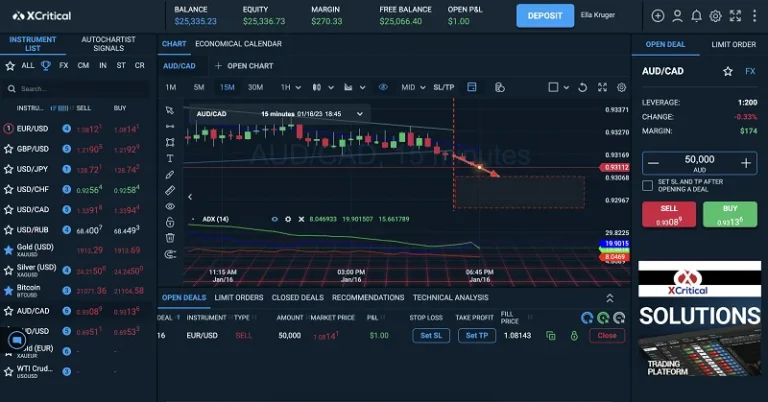

Read more about https://www.xcritical.in/ here.

- Publicado en FinTech

Ico, Ieo, And Ido: What Do They Mean And The Way Are They Different?

This increased the attraction of IDOs as a way of fundraising within the crypto sector. It’s usually easier and cheaper for a small, less-known project to launch their token by way of a DEX than a big, centralized change. You need not deal immediately with a project and belief their good contracts. A dependable IDO platform will have a number of https://www.xcritical.in/ profitable gross sales completed. If the sensible contracts are the identical, you’ll have the ability to have some trust in the providing.

Ico As First Steps To Ido In Crypto

A platform was needed to prepare the fundraising procedure, and make it harder for scammers and malicious people to prepare their fraudulent initiatives. He realizes that Bitcoin’s core decentralized architecture, the blockchain technology, could turn into a very highly effective tool that could presumably be put to use to make the whole world a better place. From financial apps, to gaming, or knowledge storing – it could presumably be used to remodel the world as we all know it.

Ico Vs Ido: Understanding The Variations And Making Informed Selections

The people behind the project (the ones who want the money), and the buyers (the ones who have the money). The team behind Pincoin promised buyers excessive returns on their funding in trade for purchasing tokens. However, most individuals would tell you that it was nothing however a well-decorated Ponzi scheme.

These Are The Principle Differences Between Ico And Ido

IDOs can entry one of the blockchain markets that’s quickly increasing and gaining reputation since they are compatible with DeFi protocols and liquidity pools. ICO, short for Initial Coin Offering, is a fundraising methodology the place a project or firm points its own cryptocurrency or token to buyers in trade for funds. The tokens are usually created on an existing blockchain platform, similar to Ethereum, and may symbolize various utilities inside the project’s ecosystem.

Ido – A Greater Crypto Fundraising Model?

The actual crypto you will want will rely upon the sale, and will even be LP tokens if you’re taking part in an IFO. It’s much simpler for an unreputable project to distribute their token by way of an IDO than it’s via an IEO with a big, regulated exchange. Investors and projects are protected when correct checks are completed. These measures help avoid the laundering of unlawful funds and the evasion of economic sanctions.

What Is An Preliminary Dex Providing (ido) And Why Do We Need Them?

It may be straightforward to get carried away and invest greater than you should. But don’t forget, gross sales are still risky, and even with sound analysis, you would nonetheless be the sufferer of a scam, fraud, or rug pull. There could additionally be a delay in whenever you get your tokens, or they could even be staked and locked for a while. Almost anything is possible depending on the project’s tokenomics, and you want to completely perceive them. There are already many trustworthy DEXs the place you’ll have the ability to participate in IDOs, including PancakeSwap and BakerySwap.

Ico, Ieo, And Ido: What Do They Imply And How Are They Different?

The SEC has moreover cautioned that some IEOs may be simply as hazardous as ICOs if they violate federal securities legal guidelines. This is a high-risk investment, you shouldn’t expect to be protected if something goes mistaken. He’s only 19 years old, however he’s a superb, promising man who has revolutionary concepts brewing up in his mind. He’s been eyeing the crypto world intently, he sees the potential that Bitcoin has, and how important the blockchain impact on the world might be.

Some Examples Of Crypto Launchpad

Hedge With Crypto aims to publish information that’s factual, accurate, and up-to-date. The details about a selected cryptocurrency exchange or buying and selling platform in reviews and guides could differ from the precise provider’s website. For smaller tasks trying to get quick funding, an IDO may be a great path to take because it can get in entrance of investors comparatively quick. For larger initiatives on the lookout for widespread exposure and long-term market dominance, ICO might turn out to be the inevitable path. From the preceding paragraphs, it can be seen that a token launch includes a series of business transactions by a cryptocurrency company before it might possibly launch a token.

Some of the funds raised are used to create a liquidity pool with the project’s token. Typically, the offered liquidity is locked for a certain interval. After a vetting course of, a project is accepted to run an IDO on a DEX.

- It makes use of blockchain know-how to offer low-cost, quick solutions in the AI and machine studying sectors, that are managed by large enterprises today.

- For bigger initiatives on the lookout for widespread exposure and long-term market dominance, ICO might become the inevitable path.

- The project is not going to own any of the tokens raised in the course of the fundraising process in an IDO.

- While IDOs supply some clear advantages, such as decentralization and quick token liquidity, additionally they current some challenges.

- The only real difference between safety tokens and stocks is that security tokens are on a blockchain instead of being registered.

For a long time, businesses struggled to boost funds for their formidable goals. The cryptocurrency change platform shall be like a third celebration in this process. The project will search the providers of an exchange, that are usually offered at a fee, and the trade will float the tokens on behalf of the project. Just like in ICOs, an IEO allows an investor to buy the tokens earlier than they are formally launched out there, creating room for major returns. The cryptocurrency house is various, and the funding choices available for brand new initiatives allow them to raise funds while participating the neighborhood. Blockchain and crypto startups can concern their tokens in trade for fiat foreign money or other cryptocurrencies.

However, the word token means a virtual foreign money token or a denomination in cryptocurrency. The word token also describes any cryptocurrency besides Bitcoin and Ethereum, and it’s used to make a buy order, make investments, or store value. Additionally, investing on-line gives buyers an opportunity to spend cash on emerging trends for the long run. However, investing in digital assets nonetheless carries a major stage of threat, so do your due diligence. The SEC is presently centered on pursuing charges against ICO issuers and initiatives that launched ICO.

- Publicado en FinTech

Yield Farming vs Liquidity Mining: A Comparative Guide

Content

- Buy crypto for yield farming and staking

- Staking – The Future of Consensus Protocols

- Liquidity Mining – The life force behind DeFi

- Yield Farming vs Staking: Which Is a Better Short-Term Investment?

- Top 5 Cryptocurrencies for Staking

- Is Leveraging Blockchain Technology In The Fight Against Deepfake Possible?

Liquidity pools help https://www.xcritical.com/ decentralized protocols operate by providing liquidity, convenience, and speed to those platforms. They also let investors who deposit funds into these pools earn passive income. It’s essentially an interesting way of pledging crypto assets as collateral on blockchain networks that leverage the Proof-of-Stake algorithm.

Buy crypto for yield farming and staking

In pursuit of high yields, yield farmers frequently switch their money between various protocols. Consequently, DeFi platforms might also defi yield farming development services offer additional financial perks to draw more funding to their system. Liquidity tends to draw in even more liquidity, much like centralized exchanges. It is also important to note that the rewards offered through liquidity mining may not be sustainable in the long term.

Staking – The Future of Consensus Protocols

Although each strategy offers different benefits and risks, both can be used to generate returns. Yield farming is the practice in which investors lock their crypto assets into a smart contract-based liquidity pool like ETH/USDT. The locked assets are then made available for other users in the same protocol.

Liquidity Mining – The life force behind DeFi

As participants involve themselves in providing liquidity to these nascent projects, they receive LP tokens, which can be a blend of the original tokens they’ve staked and the project’s native tokens. However, it’s vital to juxtapose the potential returns against the inherent risks, especially in a market known for its volatility. For many, the concept of earning passive income through liquidity mining has become synonymous with yield farming, where investors hop between various DeFi protocols to maximize their returns.

Yield Farming vs Staking: Which Is a Better Short-Term Investment?

A shift from Proof of Work (PoW) to a Proof of Stake (PoS) is in progress in the Ethereum 2.0 paradigm. Validators will need to stake parcels of 32ETH instead of giving hashing power to the network to verify transactions on the Ethereum network and get block rewards. DeFipedia is a free educational platform designed to provide open-access, comprehensive knowledge about decentralized finance to the world. We list all apps and experts, not just those that pay us, in order to provide complete and objective information.

Top 5 Cryptocurrencies for Staking

Leading decentralized exchanges like Uniswap, Balancer, and SushiSwap have been at the forefront. Each platform has its unique set of rewards, governance tokens, and terms, necessitating a comprehensive understanding before any engagement. Liquidity mining is a process where users provide liquidity to a platform, usually by depositing assets into a pool, and in return, they earn rewards. It is a system or a procedure where members contribute cryptocurrency to liquidity pools and are compensated with fees and tokens depending on their proportion of the liquidity in the pool. These pools include liquidity in specific crypto pairs that can be accessed through decentralized exchanges, commonly known as DEX.

Is Leveraging Blockchain Technology In The Fight Against Deepfake Possible?

- Validators on proof-of-stake networks use the funds staked to validate transactions and ensure the security and integrity of their respective blockchains.

- Yield farming offers higher returns than staking, as it involves moving your cryptocurrencies between different liquidity pools to find the best ROI.

- Yield farming, a subset of liquidity mining, is more strategy-intensive, where users move assets across various liquidity pools in DeFi platforms to chase the highest returns.

- Both strategies involve locking up assets to support blockchain networks and earn rewards.

- Bancor was one of the first DeFi protocols to use these pools, but the concept gained attention with the popularization of Uniswap.

- This is what makes yield farming ideal for investors who have the necessary liquidity and risk tolerance to invest in these protocols.

The primary difference is that liquidity providers are compensated with the platform’s own coin in addition to fee revenue. This means that staked assets may not be as liquid as other investment options. It’s important to consider your liquidity needs before choosing to stake your assets.

The process of providing liquidity to DeFi (Decentralized Finance) protocols, such as liquidity pools and crypto lending and borrowing services, is known as yield farming (YF). It’s been compared to farming because it’s a novel approach for “growing” your cryptocurrency. To sum it up, understanding the distinctions between yield farming and liquidity mining is crucial for anyone considering these DeFi strategies. While they both offer potential rewards, they involve different mechanisms and risks. While they share commonalities, they also possess unique characteristics that set them apart. In this comparative guide, we’ll dive into the world of yield farming vs. liquidity mining to provide a straightforward understanding of their distinctions, advantages, and potential risks.

What Is ApeSwap: Deep Dive Into the One-Stop DeFi Hub

Involving oneself in providing liquidity offers dual benefits – not only does it provide a chance to earn, but it also plays a pivotal role in keeping the decentralized ecosystem fluid and functional. It’s a dynamic interplay wherein supplying liquidity feeds into the larger architecture, ensuring seamless transactions and fostering a robust platform. Risks include impermanent loss, where the value of deposited assets can decrease compared to holding them, smart contract vulnerabilities, and market volatility affecting reward value.

While cryptocurrency regulations are still in their early stages, there is a risk that staking could become illegal or heavily regulated in the future. It’s essential to stay up to date on cryptocurrency regulations in your country and choose reputable staking providers that comply with local regulations. Read to learn what stablecoins are, how stablecoins make money, and how you can start earning with stablecoins today. He believes in cryptography, tech, code, and decentralization, and has been all-in on crypto since 2017. He has written part-time for CoinMarketCap, BitcoinerX, Flux, and several other cryptocurrency media. Traditionally, stakers are users who set up a node on their own and join any PoS network to support them as a node validator.

The potential to earn passive income, coupled with the chance to participate in the governance of a DeFi protocol, makes it compelling. However, determining if liquidity mining is worth the effort and potential risks requires a well-researched and informed approach. Given the prospective returns and the rapid evolution of the DeFi market, it’s undoubtedly a strategy that beckons attention. These platforms are actively attracting miners by offering them lucrative incentives for providing liquidity to their respective pools.

Additionally, liquidity mining may be subject to external risks such as regulatory changes, market manipulation, and flash loan attacks. Regulatory changes can impact the legality of liquidity mining and may result in the closure of liquidity pools. Market manipulation can cause sudden price fluctuations, leading to losses for liquidity providers.

This mechanism not only incentivizes liquidity providers but also ensures a steady inflow of funds into the liquidity pools. The sole determining factor in deciding between farming and staking your assets should be your taste for risks. Yield farming is a better choice if you’re confident in your trading skills and believe that gaining money in a short period is risk-worthy. Yield farming can also be considerably more confusing for beginner investors and may demand regular research and more work.

- Publicado en FinTech

Finest Bitcoin Wallets Of March 2024

Bitcoin.org formally recommends Electrum as probably the greatest Bitcoin wallets which could be put in on your computer and provides you full entry to your BTC holdings. For starters, it might possibly split your bitcoin between several wallets which is useful especially when you have bought totally different cryptocurrencies. Wasabi’s marquee function is its implementation of the trustless CoinJoin course of.

Unlike an everyday wallet, where we keep coins and banknotes, coin wallets don’t actually retailer your bitcoin. The private keys in flip provide the proof that you just own your bitcoin. Its costs vary from round $79 to $149, and Ledger can combine with many popular software wallets such as Crypto.com and Guarda.

- Plus, its bigger screen size means less chance of potential error when reviewing transactions.

- Huobi is a sophisticated, decentralized wallet (see «Crypto Trading Terms,» below) that supports trading more than 1,000 different digital property throughout multiple blockchains.

- This permits you to receive Bitcoin funds and see your steadiness, however not spend the cash, which can be helpful if you’re shopping for BTC as a long-term funding.

- You have your email handle based on which service you are utilizing like [email protected].

- You’ll additionally receive another series of characters and numbers known as a private key, and this one is just like a password.

All of the crypto wallets in our listing are non-custodial, meaning you will have full management over your non-public key (we advise utilizing a secure password manager), with out which no transactions could be made. While the companies providing crypto wallets could provide some guarantees to customers and users, the Federal Deposit Insurance Corporation doesn’t at present insure digital assets like cryptocurrency. That famous, the surroundings is evolving and a lot of government businesses, together with the FDIC, are gathering information and contemplating legislation for the longer term. With many Bitcoin wallets to select from, including a chunk of paper along with your private and non-private keys printed on it, you’ve lots of choices when discovering the best Bitcoin pockets. Whether you need an easy-to-use online pockets or a super-secure hardware pockets, there’s a good possibility on your crypto storage wants.

Trezor Model T

However, its core providing remains its desktop utility, which is suitable with Windows, Linux, and Mac operating techniques and receives regular updates every two weeks. If you need to select the most effective Bitcoin pockets, the first factor to contemplate is whether or not you prefer a sizzling pockets or a cold wallet. The Bitcoin market is rising rapidly, with institutional curiosity and mainstream adoption now at unprecedented levels. It’s an exciting time to purchase Bitcoin, and for would-be buyers, step one is selecting a safe and effective wallet to store your funds.

At CryptoWallet.com, we don’t consider that you must have to sacrifice security for convenience. There are many factors to consider when choosing a crypto wallet that lets you use Bitcoin for its supposed objective. At CryptoWallet.com, you cannot only retailer your Bitcoins but in addition spend BTC with our crypto card. Cons 👎Guarda Wallet costs transaction fees for in-app crypto purchases, with a normal transaction payment fee of 5.5%.

One Of The Best Bitcoin Wallets For 2022

Atomic Wallet presents help for Bitcoin as nicely as a variety of cryptos, making it a versatile solution for managing various digital property. Users can perform cryptocurrency exchanges within the pockets interface without having to depart the appliance. Pros 👍Ledger Nano X is the most effective Bitcoin wallet that provides a “cold storage” answer to safeguard your BTC and other property. Users can set up the Ledger software on their desktop computer and plug in the Ledger Nano X to transfer cryptos. Cons 👎CryptoWallet.com is a custodial BTC wallet which means customers don’t control their very own keys with CryptoWallet.com, unlike non-custodial solutions like Trust Wallet or Ledger hardware pockets. Users with paper wallets or non-custodial solutions have sole entry to their keys.

While that is fairly handy, it hardly justifies its costlier price tag of $179. Atomic Wallet presents a great steadiness of beginner and superior options. The wallet’s most touted options embody its assist for atomic swap transactions and staking (see «Crypto Trading Terms» and «Going Decentralized,» below). But since hot wallets are hosted on-line, they are extra susceptible to hackers. That’s why some customers look to place their crypto in chilly storage as a long-term solution.

Coinbase Wallet

The wallet is an open-source project, so there’s a sure quantity of DIY experience required. This is a superb pockets for Bitcoin traders, but there’s undoubtedly a learning curve. Climbing it only occurs via Electrum’s on-line, developer-focused documentation. Though it was originally constructed solely for desktop users, Exodus has developed right into best hardware wallet a multi-device pockets that additionally helps Android and iOS gadgets. Like Coinbase, it is mature, intuitive, and easy to use, although Coinbase has a better support program. It also helps greater than a hundred and fifty five crypto asset sorts, which is respectable, though nonetheless small when in comparison with wallets like Atomic, Coinbase, or Huobi.

You can, nonetheless, simply stake tokens using the apps that hook up with MetaMask on the web. Just do not overlook that if you’re not an enormous user of Ethereum and its related https://www.xcritical.com/ tokens, MetaMask may not be a lot help to you. The free software has some other strengths, similar to mobile and browser-based connections to decentralized purposes.

Hardware wallets like Ledger and Trezor are probably the most secure but also the least convenient. As they are offline gadgets, you’ll want to connect them to a web-based device to make use of. They may be tricky to set up which makes them more appropriate for intermediate or advanced inventors.

Ideas On “the 8 Finest Bitcoin Wallets For 2024 (editorial)”

The drawback to this accessibility is that they’re considered ‘hot’ or on-line, and due to this fact extra susceptible to malware and phishing assaults. When you open a BTC wallet, you receive a string of characters and numbers known as a public key. This is the pockets handle, and if you’d like somebody to ship you BTC, you want to give them this handle. You’ll additionally receive one other series of characters and numbers referred to as a non-public key, and this one is similar to a password. If you need to send BTC out of your pockets, you have to enter this password.

Now that you know what to search for in a Bitcoin pockets, let’s check out the highest 5 finest Bitcoin wallets. Sign up below, and get access to our Future Winners portfolio, featuring our prime crypto picks. Sign up beneath to get entry to our Blockchain Believers portfolio, with our top-rated crypto decide.

It additionally has excellent help, a vital feature for beginners stepping into what many would contemplate a confusing market. We chose Electrum because it is safe, open-source, and provides advanced features and choices. Also, I’d like to clear up a very common misconception about owning a hardware wallet. Though some people have dismissed them as a fad or even an outright con, cryptocurrencies have flourished even as their future is in flux.

It is a perfect alternative for newbies due to its simple setup process. Coinbase Wallet is a cryptocurrency wallet provided by Coinbase, a good cryptocurrency trade. It is the best BTC wallet – best for novices due to its user-friendly interface and strong safety features. The wallet helps an unlimited array of cryptocurrencies, together with popular ones like Bitcoin, Litecoin, and Dogecoin, together with 1000’s of ERC-20 tokens and tokens on EVM-compatible blockchains.

Ledger Crypto Wallet

Exodus at present allows for swaps between over 250 completely different cryptocurrencies. Electrum is open supply, allows its customers to set customized transaction charges, and has the choice to determine on between legacy Bitcoin and Segwit. It additionally provides customers the ability to determine the level of security they wish to use. For example, you possibly can create a standard pockets, one with two-factor authentication, or a multi-signature wallet. The Ledger Nano X is the second technology hardware pockets from Ledger, a French firm launched in 2014.

While it is great for beginners, more advanced users may discover it lacking in some features. This goes against the ethos of the thought of Bitcoin and blockchain and can create some security issues as its code just isn’t open for everyone to see. Instead, customers rely on the Exodus team to ensure there aren’t any holes within the safety of its wallet. We picked Exodus as greatest for novices because it is free, has good buyer assist, and elective help for chilly storage. We selected Trezor as finest for safety because it comes with the strongest security features and track document of any reviewed hardware pockets.

We checked out greater than a dozen Bitcoin wallets worldwide and selected the highest cold and warm wallets based on factors similar to safety, costs, and customer critiques. Security is obviously an enormous consideration, so it’s essential to use a wallet that is well used and has loads of security protocols in place. It’s additionally necessary to choose a wallet that works properly with a variety of the bigger exchanges to find a way to shortly complete transactions within the open market.

- Publicado en FinTech

The Last Word Guide To Understand Market Makers

The first-generation vAMMs made use of a fixed formula to calculate costs. But the second-generation vAMMs use a strong liquidity design and digital tokens to enable makers to offer amm crypto liquidity with leverage. With the basics of market makers clear, let’s study digital automated market makers (vAMMs). Lending cryptocurrencies to earn curiosity and infrequently charges are often identified as DeFi yield farming. An investor will go to a DeFi platform like Compound and amass cryptocurrency belongings to lend cryptocurrency assets to borrowers and earn interest on the loans.

Replies To “the Ultimate Information To Understand Market Makers”

Since somebody brought more potatoes to the magic warehouse, the price of potato fell underneath a rupee and apple observed a contrary impact. In the beginning the value of apples is equal to the value of potatoes because every of them is stored at a Re. However, as the buying and selling (exchange) begins one might turn out to be more priceless than the opposite thus pushing it’s worth greater than a dollar. He mentions that he knows of a village the place people are sick of consuming apples every day.

What Is Market Making In Crypto?

Users obtain curiosity funds and COMP, the native token of Compound. Depending on the actual platform, interest rates could also be mounted or variable. By enabling farmers to stake their liquidity providers’ or LP tokens—which signify their participation in a liquidity pool—some DeFi protocols may additional encourage them. Nowadays, options market makers have a complicated series of pricing fashions and risk management algorithms to help provide reasonable liquidity even in fast-changing market situations. If a bondholder wants to promote the safety, the market maker will purchase it from them.

Find Out About Automated Market Makers Within The Crypto Trade

Ethereum’s imminent merge is being intently watched given the impression it might want together with the development of Layer 2 rollups which doubtlessly reduce charges to pennies. In order for an automatic order e-book to offer an accurate value, it needs enough liquidity – the volume of buy/sell order requests. If liquidity is weak then there shall be massive gaps in the worth that customers are prepared to purchase and sell at. A excessive return on investment is what yield farming cryptocurrencies goal to deliver. The processes will embrace lending, borrowing, contributing cash to liquidity swimming pools, and staking LP tokens.

Understanding The Significance Of A Market Maker

Market makers function as key market individuals to earn earnings from the difference amount. They give buy and sell quotes to create a variety and then earn from trading volumes every day. Their trades involve a big threat as there is no guarantee of execution of each side of the transaction. Market Makers are the individuals or entities that play a crucial function in boosting market liquidity and buying and selling quantity. They work within a larger company or entity and are authorized by inventory exchanges to enhance market conditions. Their major aim is to enhance liquidity and buying and selling volume, following particular regulations set by the authorities.

- Blockchain Magazine, an unbiased platform, covers and publishes blockchain news, insights, analysis, evaluation and analysis.

- But the principle mechanism that centralised exchanges employ to generate liquidity is through external market makers.

- Another trade known as Curve, which is also constructed on Ethereum like Uniswap, is specialised for stablecoin trading.

- It’s necessary to do your research and evaluate completely different DEXs before selecting one to commerce on.

- Therefore, they are liable for executing orders acquired from buyers.

Yield farming, at its most elementary level, allows cryptocurrency homeowners to generate income from their investments. By putting cryptocurrency units into a lending mechanism, yield farming is a way for making curiosity from buying and selling commissions. Some customers receive further dividends by way of the protocol’s governance token. Some types of market makers are generally recognized as “specialists.” A specialist is a kind of market maker who operates on certain exchanges, including the New York Stock Exchange. Although their functions are related, specialists focus more on facilitating trades amongst brokers immediately on the ground of an exchange.

Essence Of Defi Liquidity Swimming Pools:

The focus of Curve Finance on stablecoins helps it in making certain minimal expenses for trades alongside lowered issues of slippage. As a finish result, DEX customers can enjoy considerable ranges of autonomy for initiating trades instantly via their non-custodial wallets. The result is a hyperbola (blue line) that returns a linear exchange worth for large elements of the value curve and exponential prices when change expenses close to the outer bounds. But it’s a narrow margin business, which suggests we must be continually on our toes, providing the right prices throughout many markets and merchandise, and all on the similar time. These market individuals turn out to be sellers to interested buyers and buyers to interested sellers.

Liquidity providers, typically abbreviated as LPs, are the backbone of those liquidity swimming pools. They may be people or bigger entities that offer the belongings to these pools. Liquidity denotes the convenience with which property may be traded with out inducing significant value adjustments.

A specialist is one type of market maker who typically focuses on trading particular stocks. Since market makers are sometimes concerned as each brokers and dealers, this creates a conflict of curiosity because, as brokers, they are supposed to offer clients with the best execution. The presence of market makers makes inventory trading safer and safer. They create volumes in stocks and keep the markets from becoming illiquid. The two-way quotes supplied by them cut back the idea threat and trading risk for market players.

They ensure that the gap between the bid and ask costs is minimal, thus allowing better rates for traders. Now that you simply perceive the market maker’s that means, allow us to discuss a number of important components. You already know that they are liable for enhancing liquidity and buying and selling volume out there.

Other areas have taken a more permissive approach and have carried out regulations to guard users. While there can be many different sorts of exchanges, these are the preferred forms DEXs can take. Since the variety of potatoes within the warehouse was greater than variety of apples, farmer could fetch solely 6140 apples for 7000 potatoes.

Automated market makers were initially launched by Vitalik Buterin in 2017. Not solely have they severely improved the capabilities of present decentralized exchanges, however AMMs have additionally made it attainable for DeFi to exist within the first place. This is creating a a lot more aggressive market for liquidity provision and can most likely end in higher segmentation of DEXs. Impermanent Loss is the unrealised loss within the worth of funds added to a liquidity pool as a end result of affect of worth change in your share of the pool. It’s a factor of the automated nature of DEFI and the volatility of the worth of asset pairs. One of the exact issues of the AMM method to decentralised exchanges is that for very liquid swimming pools plenty of the funds are sat there doing nothing.

- Publicado en FinTech

Spot Trading: A Step-by-step Information For Novices 2024

Fundamental analysts also look into the project’s adoption potential in the true world. Factors corresponding to Crypto Spot vs Derivatives Trading partnerships, use instances, community engagement, and market demand may also influence prices. Keep in thoughts that on the earth of investing, dangers and potential returns usually go hand in hand. Taking on greater risks would possibly result in higher potential returns, though it additionally raises the chance of shedding your invested capital. For newbies, a software program pockets, also known as a scorching wallet, is usually beneficial.

Professionals And Cons Of Crypto Spot Trading

Spot buying and selling in crypto works on an change the place traders purchase or promote cryptos utilizing fiat forex or other cryptos. The change https://www.xcritical.in/ acts as an middleman between consumers and sellers, and the availability and demand of the crypto in question determine the market price. Spot trading is enticing for its simplicity, low transaction charges, and immediate execution of trades.

- The standard definition of a trend line defines that it has to touch the worth a minimal of two or three times to turn into legitimate.

- It connects all the closing prices of a cryptocurrency over a certain interval with a single line.

- Spot buying and selling is immediate, which means a trade is accomplished as quickly as the order meets the target purchase or promote price.

- Factors similar to partnerships, use instances, community engagement, and market demand might additionally influence prices.

Crypto Spot Trading Defined: The Way To Trade Like A Pro

Spot trading is among the more simple ones, however it still has strengths and weaknesses. When a futures contract reaches its expiry, the buyer and seller often comply with settle the trade in cash, quite than really exercising the contract. In traditional markets, shopping for stocks additionally generates earnings within the type of dividends, where firms distribute a portion of their earnings to shareholders. Unlike conventional currencies, that are issued by central banks, cryptocurrencies are not controlled by any central authority. This decentralization is feasible due to using blockchain technology, which permits transactions to be verified and recorded in a distributed and transparent manner.

The Method To Spot Commerce Crypto Securely?

Additionally, technological developments and increased adoption of cryptocurrencies could present a constructive enhance to the market. At press time, the Ethereum value is 19.49% down at $2,340 amid the broader market sell-off. You can utilize advanced order varieties to lock in profits or protect yourself from losses.

Spot Buying And Selling In Crypto: A Complete Information

He explains that merchants are extra likely to successfully buy at a worldwide bottom than to brief at a global prime. This is because most belongings tend to increase in worth over extended durations. One of the vital thing differences between proudly owning a spot ETF and owning the precise cryptocurrency is custodial accountability. When you own a cryptocurrency, you should manage its storage and security, which includes utilizing digital wallets and understanding non-public keys. Futures trading typically permits for greater leverage, which means merchants can management bigger positions with much less capital. There are quite a few risks in cryptocurrency trading, together with regulatory risk, market risk, operational threat, liquidity danger, and safety threat.

Derivatives traders basically place a wager on the value of a crypto asset going up or down; known as crypto futures or choices. In crypto trading, merchants use two well-liked methods—spot trading and futures trading. Both methods have their characteristics and advantages however additionally they include dangers.

Advantages And Downsides Of Crypto Spot Markets

The change typically can’t completely fill your order on the value wished, so you have to take larger prices to complete the order. The first milestone in your spot trading journey is choosing the proper crypto change. A reputable and controlled platform like Coinmetro will help you align with your buying and selling goals and preferences. Should you want any help, feel free to reach out to our world-class Customer Support Team by way of 24/7 live chat or e mail at Lastly, the inherent volatility of cryptocurrencies cannot be ignored.

Miners and long-term holders typically use futures contracts to guard their portfolios from surprising dangers. Spot buying and selling is a famous technique merchants use when shopping for and selling the underlying crypto asset wherein the transaction is determined instantly. To achieve maximum income, spot merchants purchase any crypto token, corresponding to Bitcoin or Litecoin, at a low price and promote it at a high worth.

Here’s an in depth look at what spot buying and selling is, how it works, and why it’s necessary. Spot trading stands as a foundational pillar within the realm of cryptocurrency buying and selling, providing immediacy and direct possession of property. Liquidity is crucial in spot buying and selling because it determines the benefit of executing trades.

What is cryptocurrency buying and selling and how are you going to trade cryptocurrencies? It has been ready without taking your goals, financial state of affairs, or wants into account. Any references to previous performance and forecasts are not reliable indicators of future results. Axi makes no representation and assumes no legal responsibility concerning the accuracy and completeness of the content material on this publication. Similar to traditional inventory exchanges and on-line brokerages, centralised exchanges conduct large-scale cryptocurrency transactions using the order book model to match patrons and sellers. Peer-to-peer trading allows traders to trade cryptocurrencies among themselves.

Spot buying and selling empowers you to seize alternatives and execute transactions in real-time, making it a vital avenue for those looking for quick involvement of their trading endeavors. Margin trading is on the market in some spot markets, but it’s not the identical as spot buying and selling. As we previously mentioned, spot buying and selling requires you to fully purchase the asset immediately and take supply. In distinction, Margin trading lets you borrow funds with curiosity from a 3rd celebration, which permits you to enter bigger positions. As such, borrowing offers a margin trader the potential for more vital profits. However, it additionally amplifies the potential losses, so you ought to be careful to not lose your whole initial investment.

Spot transactions, also called spot trades or spot contracts, are financial transactions the place the supply of the asset or financial instrument takes place instantly, or “on the spot”. The term “spot” refers back to the transaction being carried out on the spot, at that moment, rather than at a future date. While a lot less complicated than other techniques, spot buying and selling is not utterly risk-free. However, researching any cryptocurrency before you buy them is a must. There’s actually no alternative to studying and researching cryptocurrencies as extensively as attainable.

Spot crypto buying and selling is a straightforward approach to participate in cryptocurrency buying and selling. However, like some other investment or buying and selling strategy, there are nonetheless dangers concerned, and you would doubtlessly lose all of your capital. Finally, it’s necessary to research the cryptocurrency you would possibly be buying and only trade what you can afford to lose.

- Publicado en FinTech